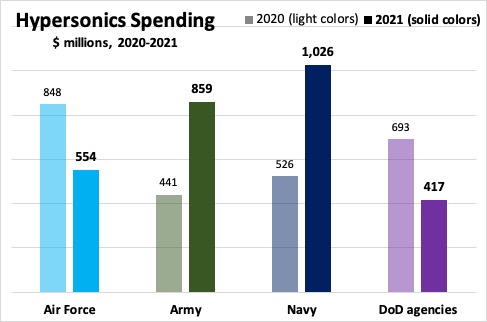

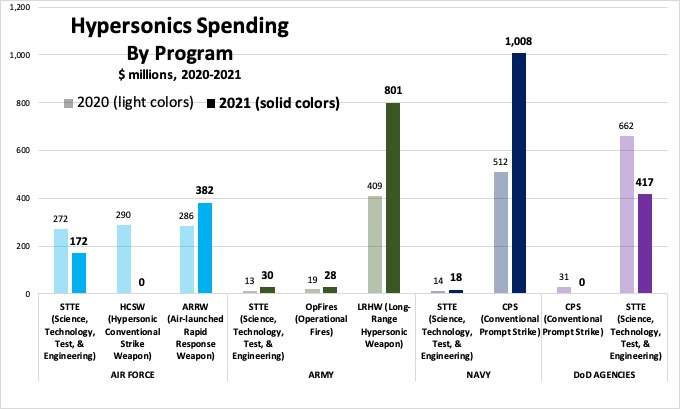

While Army and Navy spending nearly double, Air Force and independent agency spending drops almost 40 percent.

By THERESA HITCHENS and SYDNEY J. FREEDBERG JR.on April 14, 2020 at 4:07 PM

Breaking Defense graphic from DoD data

WASHINGTON: The Pentagon is asking Congress for $2.865 billion for hypersonic weapons in 2021, up not quite 14 percent from a 2020 total of $2.508 billion, according to DoD budget documents obtained by Breaking Defense.

Army and Navy hypersonics spending would nearly double in 2021. Each increases by 95 percent. But that's offset by a 40 percent reduction in spending by independent defense agencies like DARPA, which are handing off much of the work to the services as programs move from basic research to prototyping, and a 35 percent cut in the Air Force, which cancelled one of its two major hypersonics programs.

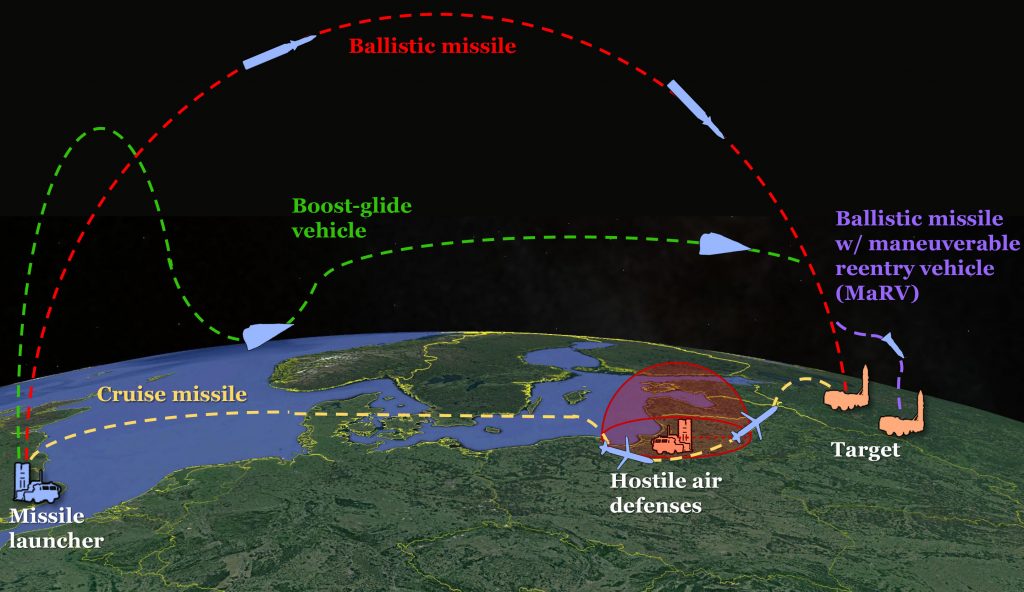

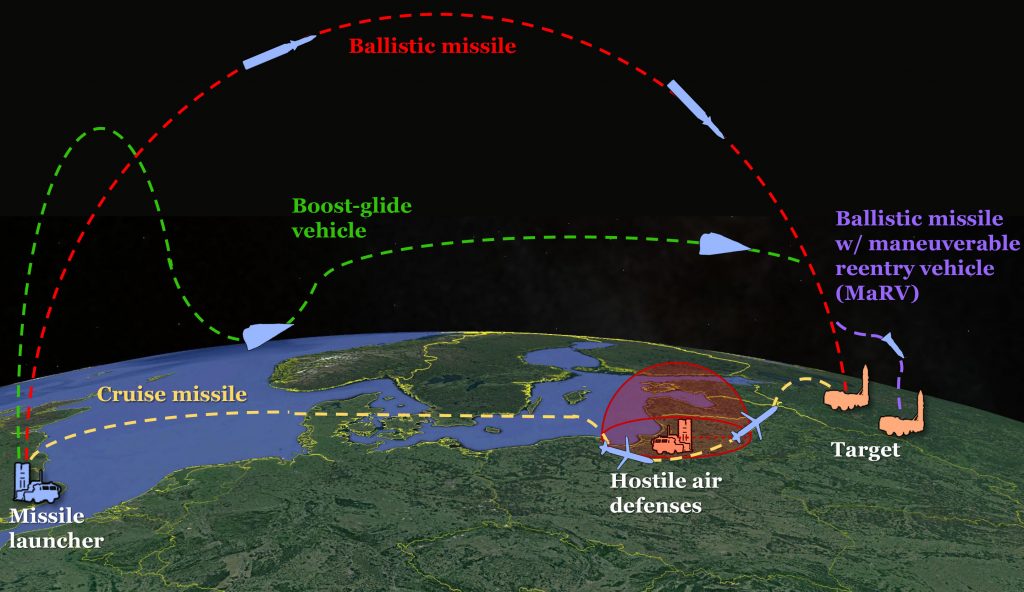

Hypersonic weapons fall into two main categories. The more conservative approach — relatively speaking, since these are all bleeding-edge weapons — is known as boost-glide, because it uses a conventional rocket booster to accelerate the weapon to hypersonic speed, after which the glide body containing the warhead detaches from the booster and coasts, skipping along the upper limits of the atmosphere like a stone across a pond. The Navy and Army programs are both boost-glide weapons, and the two services are using a common booster rocket, built by the Navy, and a Common Glide Body, built by the Army and lead contractor Dynetics. The Navy also plans to customize the weapon to launch from submarines, while the Army version will fire from trucks, a much simpler engineering challenge.

Notional flight paths of hypersonic boost-glide missiles, ballistic missiles, and cruise missiles. (CSBA graphic)

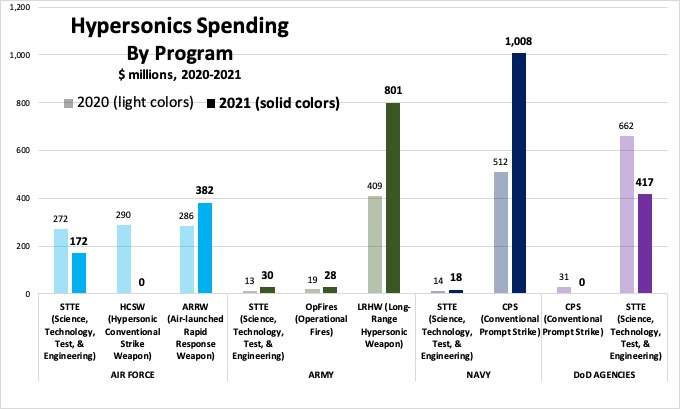

The Air Force had two boost-glide programs. HCSW (pronounced hacksaw), the Hypersonic Conventional Strike Weapon, which would have used a modified version of Army-built Common Glide Body. But the Air Force decided to cancel HCSW and focus its efforts on the more compact ARRW (arrow), the Air-launched Rapid Response Weapon. (Both HCSW and ARRW are Lockheed Martin programs).

Finally, DARPA is working on an alternative to boost-glide: air-breathing hypersonic cruise missiles that spend their entire flight in the atmosphere, with their engines providing continuous thrust. That allows the engine to take in oxygen from the air as it flies, rather carrying bulky oxygen tanks — as a boost-glide weapon's rocket boosters do. But flying through the atmosphere also creates friction, heating up an air-breathing hypersonic weapon in ways a boost-glide design, which spends most of its time in a near-vacuum, doesn't have to worry about.

Since the air-breathing technology is more ambitious, it remains a DARPA effort for now, with two contracts: Northrup Grumman and Raytheon are working on the Hypersonic Air-Breathing Weapons Concept (HAWC) and Lockheed Martin on the Hypersonic Strike Weapon air-breathing (HSW-ab). While these programs will probably transition to the Air Force in the near future, they don't yet have their own budget lines in the documents we obtained; they're almost certainly folded into the figure for independent defense agencies.

Breaking Defense graphic from DoD data

The documents summed up a portfolio of programs the Pentagon now refers to as “missile defense and defeat,” a euphemism which combines offensive and defensive programs. As Breaking D readers know, DoD has taken to lumping long-range strike efforts known as left-of-launch into its budget reporting on missile defense, with a total of $3.26 billion included for such activities in the 2021 request. Spending on hypersonic weapons is listed as a subcategory of “nontraditional” missile defense funding, defined as:

funding for missile defeat efforts outside of the above missile defense efforts. This captures ‘left-of launch' efforts that defeat missiles before they take flight via high-speed strike (e.g. Conventional Prompt Strike) or cyber-attack operations.

We combed through the document to extract the offensive hypersonics programs from traditional missile defense, directed energy (lasers), cyber warfare, and other means of neutralizing enemy missile salvos.

The document broke down 2020 funding and 2021 requests for Army, Navy, Air Force and defense-wide, both for foundational science, technology, test and evaluation (STTE) as well as for each individual service's programs to develop hypersonic missiles. Meanwhile, the Missile Defense Agency and the Space Development Agency are working on a space-based sensor to detect adversary hypersonic and cruise missiles, under the Hypersonic & Ballistic Tracking Space Sensor (HBTSS) Prototyping program.

The Navy is the big spender in 2021, with the bulk of the funds slated for the Conventional Prompt Strike (CPS), a submarine-launched boost-glide weapon set to enter service in 2025. Its total hypersonic budget in 2020 is set at $526 million, but jumping to just over $1 billion in the 2021 request. (DoD agencies spent $31 million in 2020 wrapping up their portion of CPS, but the whole program will be in the Navy budget as of 2021).

The Air Force's 2020 budget includes $848 million, the budget documents show, but that drops in the 2021 request to $554 million due to the cancellation of HCSW. The Air-launched Rapid Response Weapon (ARRW) is funded at $286 million in 2020 and the service is asking for $382 million in 2021.

As for the Army, the documents put 2020 spending at $441 million, and the 2021 request is for $859 million. That increase is driven by a big jump in the budget for the land-based version of the common Army-Navy boost-glide weapon, the Long Range Hypersonic Weapon (LRHW), from $409 million in 2020 to $801 million in 2021.

(This LRHW line item also includes some work on the cancelled Mobile Intermediate Range Missile. DoD never said publicly what MIRM would be, or even whether it would be a hypersonic missile or a conventional ballistic missile, and it appears to have been stillborn).

The documents also show the Army spending $19 million on the Operational Fires ground-launched hypersonic missile program in 2020, and asking for another $28 million in 2021. OpFires is a joint program with DARPA. Lockheed Martin scored a $31.9 million contract from DARPA in January to begin Phase 3 Weapon System Integration under the program.

https://breakingdefense.com/2020/04/exclusive-dod-asks-2-9b-for-hypersonics-in-2021