September 4, 2020 | International, Aerospace

Poland, Romania tee up helicopter tenders, target 2 percent defense spending

By: Jaroslaw Adamowski WARSAW, Poland — A number of Eastern European allies aim to maintain their defense expenditures at 2 percent of their respective gross domestic products despite the current economic downturn. Poland and Romania are at the forefront of the region's military modernization efforts, and both plan to spend billions of dollars on helicopters in the near future. However, local observers say the countries' defense acquisitions are facing delays due to organizational limitations. In a sign of commitment to modernizing its military with Western-made gear despite budget cuts, Poland decided to host the MSPO defense industry show in Kielce this year. The pandemic has forced the event's organizers to cut the show to three days, Sept. 8-10, as travel restrictions forced the majority of foreign defense companies to skip the event. Over the past years, Warsaw has increasingly focused its efforts on large procurements by foreign manufacturers, such as the $4.75 billion deal to to buy Raytheon's Patriot air-and-missile defense system and the $4.6 billion contract to acquire 32 F-35 Lightning II fighter jets from Lockheed Martin. Due to this, some observers claim Poland's defense industry is in urgent need of orders, or partnerships with foreign producers, to stay financially afloat. “A situation in which Poland only buys ready weapons off the rack is a bad one,” retired Gen. Mirosław Różański, president of the Stratpoints Foundation and former General Commander of the Polish Armed Forces, told Defense News. “Developing the defense capabilities of any country cannot solely consist of acquiring the most modern types of weapons, but also enabling its local industry to service and repair, and preferably to produce, or at least jointly produce them with foreign partners.” “As long as Polish officials will claim that we can build submarines or tanks on our own, this won't lead us anywhere. We must build partnerships, just like the rest of the world does. The flagship F-35 project is driven by an elite group of nine countries,” Różański said, adding that past plans to integrate Poland's leading, state-run defense group PGZ within a large international defense group represented a missed opportunity. Slawomir Kulakowski, the head of the Polish Chamber of National Defense Manufacturers, told Defense News most of Poland's defense companies supply their products to the country's military as export sales have lagged. Their increased cooperation with foreign players could pave the way for the introduction of various new weapons, according to Kulakowski. “In some foreign defense contracts, the Polish government includes the requirement for foreign companies to cooperate with the Polish industry. Other deals include offset requirements, but these are often criticized for boosting the weapons' prices without generating comparable benefits,” Kulakowski said. “Better contracts foresee transfers of technology to Polish plants, allowing them ... to modernize their offer, expand to new markets.” Some of the country's much-awaited defense tenders include the planned acquisitions of new helicopters for the Polish Air Force. These include the 32 multirole copters under the Perkoz program, with the first squadron to be delivered by 2026, bolstering the military's transport, combat support, command, and reconnaissance capacities. They are to replace the Air Force's outdated Mil Mi-2 and W-3 Sokol copters. The ministry also aims to buy 32 combat helos under the Kruk program, with the first squadron to be supplied until 2026, and a second one after 2026. The aircraft are to replace Poland's Soviet-designed Mil Mi-24 helos. With the two programs facing delays, though, the ministry has turned to smaller acquisitions. In January 2019, Warsaw signed a contract to buy four S-70i Black Hawk copters from Lockheed Martin's subsidiary Sikorsky for some 683.4 million zloty (U.S. $186 million). Three months later, Poland signed a deal with Leonardo to acquire four AW101 helicopters for some €380 million (U.S. $454 million). Kulakowski said the much-awaited transformation of the Armament Inspectorate, the ministry's unit that handles acquisitions of military gear, into an Armaments Agency, fitted with broader competencies and increased workforce, could accelerate procurements. According to Różański, to reform Poland's defense acquisition system, the potential Armaments Agency should be established as a government entity, and not a unit subordinated to the ministry. “Two conditions must be met for such an endeavor to be successful. Defense acquisitions must be taken out of party politics, and they must be delegated to a team of competent, politically neutral experts that will be responsible for long-term planning and execution of our modernization programs,” Różański said. Contenders in Romania In Romania, the country's defense establishment has been mulling plans to purchase new copters since 2015, but a decision to launch a tender has yet to be made. George Visan, the coordinator of the Black Sea Security Program at the Bucharest-based think tank Romania Energy Center, told Defense News the Defense Ministry “would like to acquire two types of military helicopter: an attack helicopter and medium-size transport type helicopter. Before the pandemic, a helicopter procurement program was to start this year or in 2021.” With these purchases in mind, Romania has filed a request for information with the U.S. government for a potential acquisition of 24 attack helicopters and 21 medium-size transport helicopters. There are three U.S. and European helo producers that are expected to compete for the order. This said, Bucharest will most likely select an offer that brings manufacturing jobs to Romania through partnerships with local businesses. Eyeing the contract, Airbus Helicopters has shifted its assembly line for the H215M copter to Romania, and established a partnership to make medium-size helicopters with local aircraft plant IAR Brasov, according to Visan. “Airbus wants to sell its H215M and build it here in Brasov, the company is also offering the H145M which is presented as an attack helicopter. The second contender is Bell with the AH-1Z Viper and the UH-1Y Venom,” Visan said. “Finally, the third contender is Lockheed Martin with the Sikorsky UH-60M.” https://www.defensenews.com/global/europe/2020/09/03/poland-romania-tee-up-helicopter-tenders-target-2-percent-defense-spending/

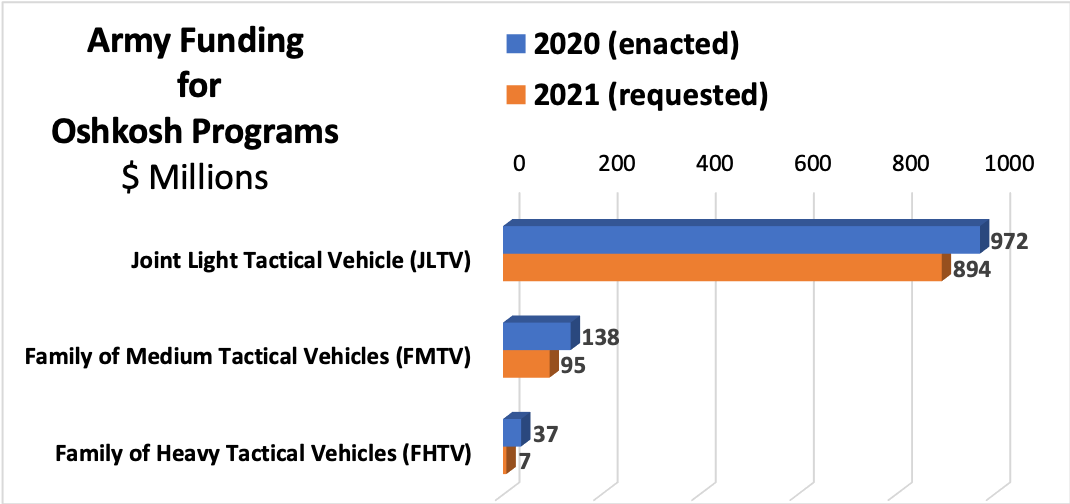

That's especially worrying for the Wisconsin company, because JLTV is

That's especially worrying for the Wisconsin company, because JLTV is