After decades of building traditional helicopters in traditional ways, contractors must get ready for the Army's new high-speed Future Vertical Lift aircraft. Small makers of key parts need help.

By SYDNEY J. FREEDBERG JR.on May 06, 2020 at 2:14 PM

WASHINGTON: What worries the Army's aviation acquisition chief as he helps industry get ready to build a revolutionary new generation of aircraft in the midst of a global pandemic? “It's the mom and pop shops,” Patrick Mason said today. “It's the Tier 3 suppliers, typically on the hardware side.”

“Those are the ones we remain focused on, because those are those are the ones that can end up in a single point failure,” the program executive officer for Army aviation continued. “That's what we're doing right now through COVID and we're going to continue to do that as we look ...to Future Vertical Lift.”

While the big Tier 1 prime contractors should be fine, they depend on smaller Tier 2 suppliers for key components, and they depend on yet smaller Tier 3 suppliers. As you trace the provenance of a crucial component down that supply chain, you all too often find a single point of failure. That's some tiny, easily overlooked company that happens to have the only people who know how to build a particular part, like an actuator or a valve, or the only one who can apply a particular heat treatment or protective coating to someone else's part so it can survive the stresses of flight.

It would be easier if the Army was just winding down production of one kind of traditional helicopter and ramping up another. Then industry could build any new parts required in the old way. But Future Vertical Lift is about building new kinds of aircraft in new ways.

Even the most traditional-looking competitor, Bell's proposal for the FARA scout helicopter, is being designed, built, and tested using new digital tools. Those tools allow much greater precision and efficiency than traditional blueprints, but only for facilities that have the necessary technology installed. Bell and its rivals, Sikorsky and Boeing, are also all eager to use 3D printing and other advanced manufacturing techniques to improve the performance and reliability of key parts while reducing their cost. That's another set of new technologies that small firms can't easily afford.

Will increasing sales of drones help make up the revenue? In addition to the optionally manned FARA scout and FLRAA transport, which will have human crews aboard for most missions, FVL is also building a whole family of completely unmanned aircraft.

The major companies can get in on much of that business, Mason said, but some of their smaller suppliers can't. If you build electronics or write flight control software, then. you can work on either manned or unmanned aircraft. But, Mason said, if you specialize in building a particular kind of hardware for manned aircraft, most drones are so much smaller that they use entirely different systems, such electric actuators instead of hydraulics. So for small manufacturing shops, he said, “there's less synergy.”

Mason's concerns were well supported by a study of the FVL industrial base by the Center for Strategic & International Studies, released today.

“The primes are all in,” said Andrew Hunter, director of defense industrial studies at CSIS, who hosted yesterday's call, “[but] it's a big challenge for those Tier 3 and lower suppliers to make this transition.”

During months of workshops with industry, “the concern that we heard expressed repeatedly was lower down the supply chain, [with] Tier 3 and lower suppliers,” Hunter said. “It's an expensive investment that they may be challenged to raise the capital to do, [and] it certainly will involve retraining their workforce to use these new manufacturing techniques.”

“Industry has to see they're going to get a return on that investment,” he said. “Even optimistic management who are true believers and think they are definitely going to get a return on this investment because they're going to win [FVL contracts], they've still got to justify it to the banks. They've still got to justify it to their corporate boards.”

Changing The Rules

What complicates the business case for contractors is that the Army wants a new approach, not just to building the new aircraft, but also to how it keeps them flying.

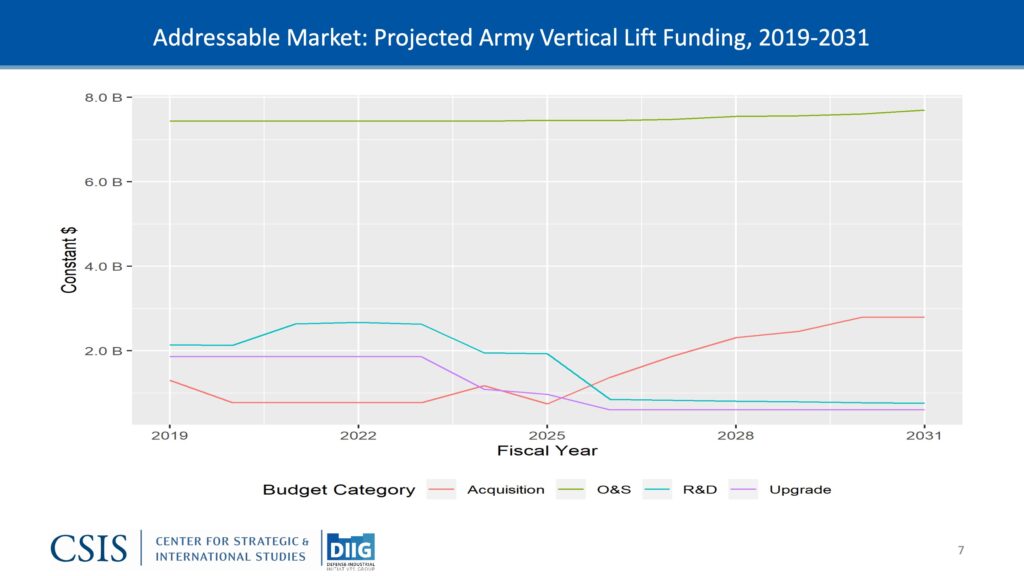

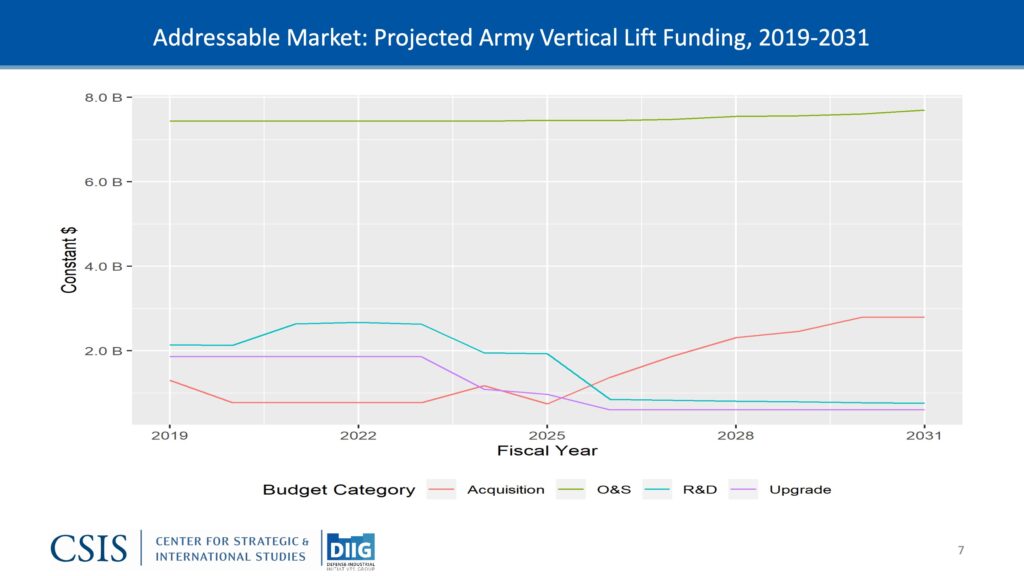

Over an aircraft's decades in service, the long tail of operations, maintenance, and upgrades dwarfs the up-front cost of research, development, and acquisition. While the CSIS study calculated that the Army could afford to build the Future Vertical Lift if budgets remain near historical averages – not guaranteed in the wake of the pandemic – the bigger risk is whether or not the service can control those Operations & Sustainment costs in the long term.

Army Futures Command's director for aviation modernization, Brig. Gen. Walter Rugen, said he was confident that extensive physical prototyping and digital modeling would help the service get a handle on those costs. “Our requirements... are still in draft form, so if we need to trade one away to maintain our budgets, we will do that,” he said. “We are going to understand to the greatest degree possible what our O&S costs are and make sure that it's within our budget.”

For helicopters, Hunter said, O&S is typically 65 percent of the total cost over the lifetime of a program. Now, not all that money goes to aerospace contractors, since sizable chunk goes to pay military maintenance personnel, buy fuel, and so on. But contracts to sustain existing aircraft are a more important revenue stream for most contractors than actually building new ones.

While projected spending on R&D (blue) and procurement (red) rise and fall, remaining under $2.5 billion a year, Operations & Sustainment costs (green) remain largely constant at over $7.5 billion — a crucial source of cash for industry. (CSIS graphic)

So any Army effort to economize on operations & sustainment hits contractors where they live. What's more, the Army isn't just trying to squeeze savings out of the existing process; it's changing the rules of the game.

Historically, companies could bid low to build a new weapons system because, once they got the contract, they had a de facto monopoly on maintaining and upgrading that system for decades. Now the Defense Department is pushing hard to break this “vendor lock” in two main ways:

- It's increasingly requiring companies to hand over their intellectual property and technical data. The government can then give that data to potential competitors trying to build cheaper alternatives, as on the Army-run Joint Light Tactical Vehicle program.

- Second, it's requiring companies to make their products compatible with government standards for how different components fit together physically and connect electronically, with the aim of creating Modular Open System Architectures where you can swap out one company's component and replace it with another vendor's. Developing a common MOSA for all manned and unmanned aircraft is a top priority for the Army's Future Vertical Lift initiative.

“Part of what we're doing [over] the next year, year and a half, is the strategy associated with the operational availability, that we want out of these platforms, the intellectual property we want to obtain,” Mason said. “What's the valuation of the IP, the intellectual property? Because intellectual property drives their ability to control the aftermarket, and the aftermarket is where you see the year over year cash flow [that's] critical to most of their business models.”

“As you look at Modular Open System Architecture...the business case and the business model associated with it is something that we're working through with industry right now,” Mason said. “It is critical that we have the right incentive structure, it is critical that we provide the right framework so that industry continues to invest and they continue to see a return on that invested capital.”

To prevail in future conflicts, “we can't afford not to do Future Vertical Lift,” Brig. Gen. Rugen said. “What this report talks to is national interest we have in preserving the rotorcraft industrial base as we go forward.”

https://breakingdefense.com/2020/05/armys-shift-to-fvl-poses-big-risks-for-small-suppliers/