By Adil Khan, Jim Adams and Steve Beckey Forbes; KPMG Contributor

Jun 23, 2020

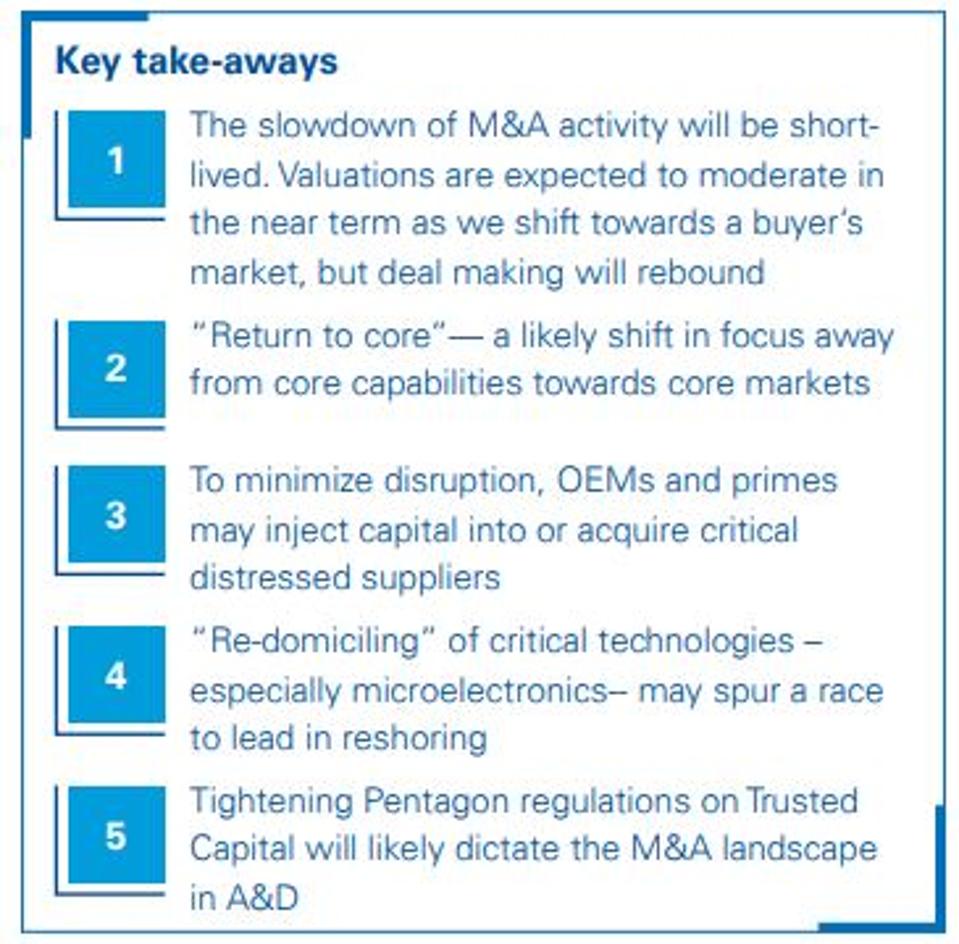

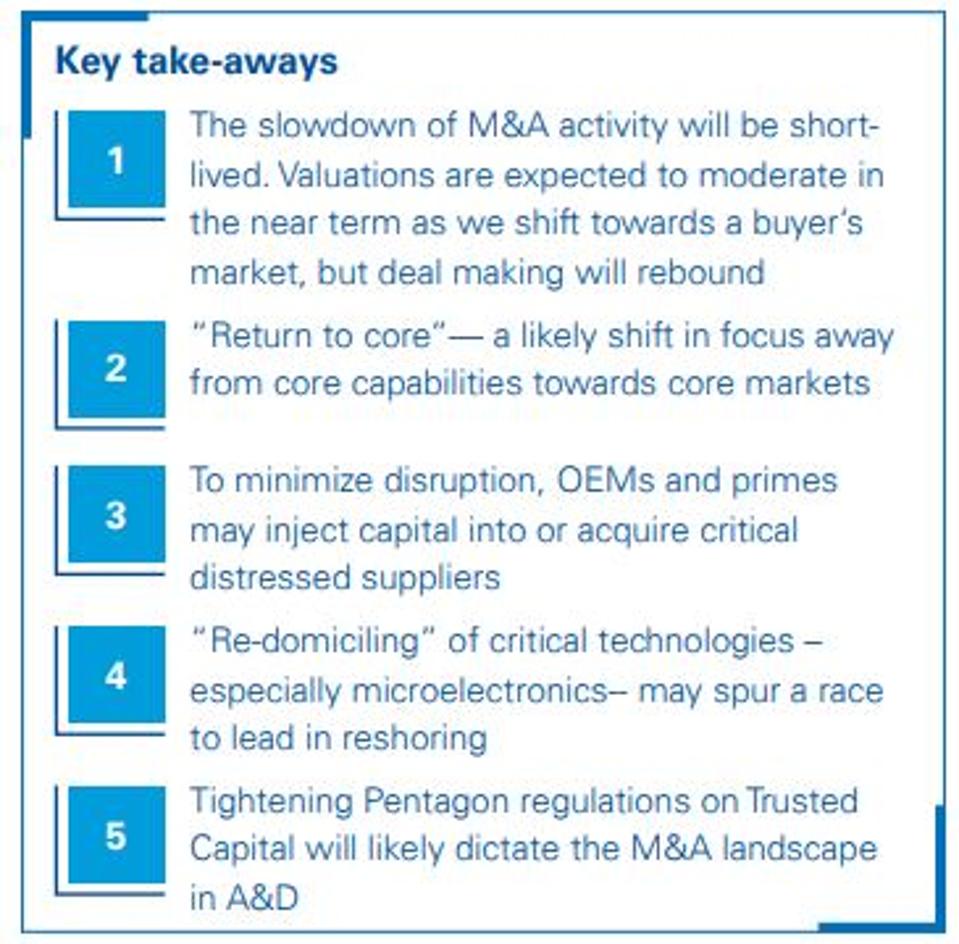

The current economic disruption—coming on the heels of the 737MAX suspension—has varying impact across A&D segments. The impact on commercial aerospace has been immediate and extensive, while the defense sector has largely remained unscathed. However, it is hard to see how it will remain so, given the extensive fiscal measures being taken. What will this mean for M&A in A&D? Some trends are beginning to emerge that will affect the entire deal life-cycle (from deal strategy through integration and value creation). Yet, as in other times of economic disruption, new opportunities will emerge, which leads us to believe that the slowdown of M&A activity will be short-lived. As we enter this next phase, deal makers who adapt quickly to the realities of the new industry landscape could be well positioned to maximize value.

Pre COVID-19 environment

Not too long ago, commercial aerospace was booming, with year-over-year ramp ups in build rates and record backlogs. There were expectations of another golden decade — further extending the unprecedented 14-year “super up-cycle”, defying the long-standing cyclicality of the sector.

However, in 2019, the historic correlation between GDP, air-traffic growth, carrier profitability, orders and build rates was suddenly disrupted. GDP and airline profitability levels remained relatively healthy, but new orders and build rates dropped as the industry grappled with the 737MAX shock, as well as a slowdown in the twin-aisle segment. Other undercurrents also emerged — slowdowns in world trade from escalating tariff tensions, weakness in high-growth geographic markets such as China and India, and declining consumer confidence.

In contrast, U.S. defense spending was on the rise, averaging 4 percent1 annual growth over the past 5 fiscal years; the $738 billion FY2020 defense bill2 ensured this momentum would continue. The government services sector was also set to benefit from continued funding increases to modernize IT infrastructure and address evolving national security challenges.

With general confidence in the long-term fundamentals of the sector and a favorable budgetary environment, players in certain A&D segments pursued M&A to build scale. Others “re-realized” that content matters and initiated vertical and horizontal integration strategies to capture more value and drive cost competitiveness, or acquired targeted niche capabilities and emerging technologies. We also saw the emergence of Super Tier I's through scale-driving consolidation aimed at broadening capabilities and potentially exerting greater influence on OEMs.

Deal volume in the A&D sector reached record levels — almost doubling over the last 5 years and outpacing the broader M&A market by 40 percent.3 Valuations remained elevated on the strength of high bidder interest, limited supply of attractive assets, high A&D stock valuations (which outperformed the S&P 500 by 8 percent),4 as well as healthy balance sheets and strong cash positions. TEV/EBITDA multiples for A&D transactions averaged 11x,5 outpacing increases in the overall M&A market. Although, deal volumes moderated in the second half of 2019, amid elevated uncertainty about defense spending heading into a presidential election year, the overall outlook remained optimistic.

COVID-19 impact

COVID-19 caused a precipitous collapse in air traffic. With travel restrictions and stay-at-home orders, carriers around the globe made unprecedented cuts to capacity, idled fleets, and began deferring or canceling new aircraft deliveries. Also, the MRO (maintenance, repair, and overhaul) and aftermarket segments, which had benefited from the prolonged 737MAX grounding and high fleet utilization, suddenly faced stiff headwinds.

Thus far, the defense industrial base has not experienced a COVID-19 demand shock. There is no noticeable disruption in appropriations or major delays and cancellation of military programs. However, as in the commercial sector, defense contractors are actively monitoring their supply base and taking steps to preserve liquidity, minimize supply chain disruption, and taking measures to comply with CDC and local government guidelines. The range of scenarios for defense spending is bookended by two scenarios: an elevated national security threat that would preserve or accelerate funding, or a reordering of budget priorities to fund social and other mandatory programs, resulting in sequestration-type measures, similar to 2011.

With these developments, volatility in the financial markets, lack of access to financing, alternative more pressing liquidity needs by corporates and most importantly, uncertainty in the marketplace, deal flow in A&D has come to an immediate standstill. Several “in-flight” processes have been halted, new deals in the pipeline have been deferred, and even some announced transactions terminated. Access to the new public offering market is effectively closed.

The gap in expected valuations between buyers and sellers has widened considerably, due to disparate perceptions of the extent of economic disruption caused by COVID-19; contrasting views on reopening of the economy and the pace of return to normal; and diverse perspectives on what the post-COVID-19 new reality looks like. This has rendered financial forecasts and pre-COVID-19 market perspectives obsolete. Further, the extent and nature of unusual and non-recurring events6 impacting financials, present considerable challenges for deal makers to form a credible view of normalized earnings and cash flows.

With the lack of reliable projections, it is nearly impossible to form a credible view on valuations let alone bridge this gap. Additionally, although M&A teams have attempted to navigate through practical challenges with offsite due diligence, virtual facility tours, video conferences, etc., adapting to a virtual M&A environment, especially for cross-border deals, has been challenging.

Developments to watch as economies reopen

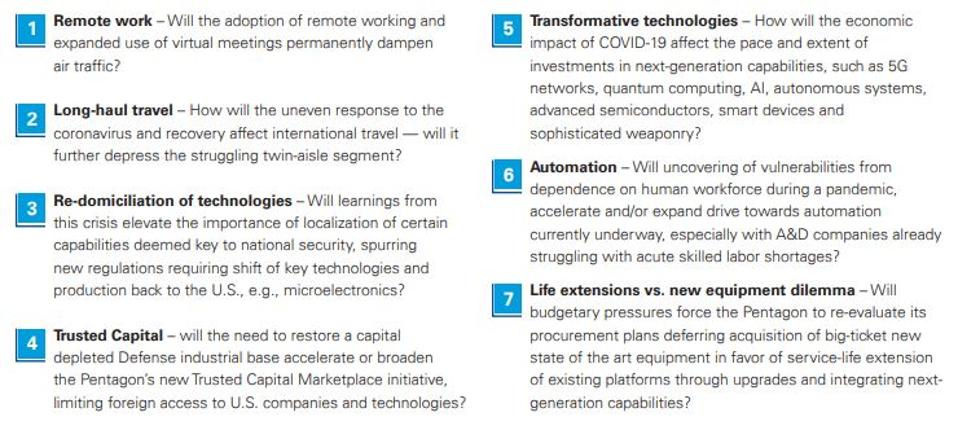

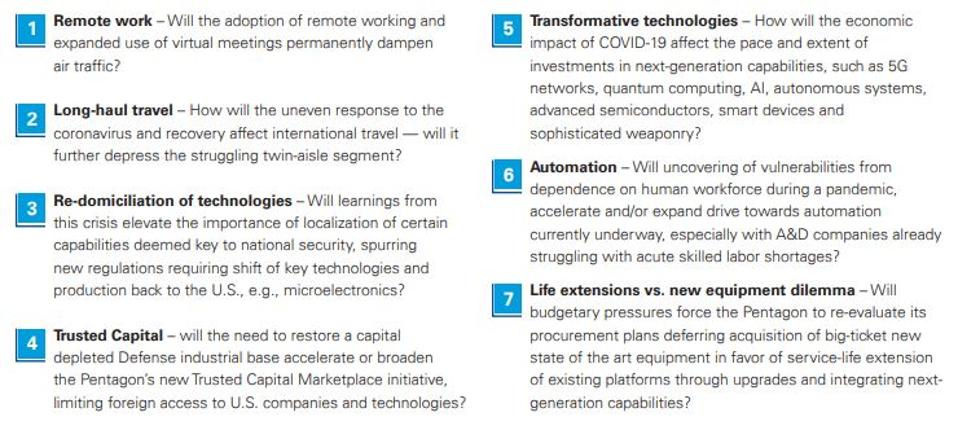

Given the health concerns, changes in social behaviors (some of which may be slow to reverse) and anticipated lead-time to an effective vaccine, a V-shape recovery in air traffic appears increasingly unlikely. As governments move from combating coronavirus to reopening economies, the pace and extent of the economic recovery is expected to vary significantly around the world. Further, some long-lasting or permanent developments may trigger some dramatic shifts in the sector:

KPMG

Implications for M&A trends and outlook

KPMG

Although we probably do not expect to see M&A activity return to the pre-crisis levels immediately, we expect M&A activity to drive realignment of the industry landscape in the post COVID-19 environment.

Implications for M&A Capabilities

As we enter the next phase, deal makers will need to adapt to the realities that impact how deals get done. Examples include:

KPMG

While the challenges are intimidating, the opportunities will be vast, and those who move quickly and decisively are likely to be rewarded for years to come. Those who take this unique opportunity to prepare and are ready to act will stand ready to reshape the A&D industry.

1. 2019 DoD Comptroller Data (Green Book)

2. Department of Defense

3. CapIQ, Institute for Mergers, Acquisitions, and Alliances

4. Year return, S&P A&D index vs S&P 500

5. Trailing 12-month average to June 2019 and avg. 16x for deals >$500M in value; CapIQ, Dacis Company reports and Press releases

6 Worker furloughs, facility shut-downs, loss of business or order cancellation, idled or underutilized facilities, CARES Act funding, changes to performance-based compensation structures or payouts, health and sanitization related measures, IT infrastructure investments to adapt to remote working environment, deferral of payroll taxes, carryback of NOLs, increased interest expense tax deduction, etc

KPMG Contributor